Businesses operating with fixed-term employment contracts must prepare for significant regulatory changes that will impact their hiring strategies, contract structuring, and compliance obligations. The Fair Work Amendment (Fixed Term Contracts) Regulations 2023 introduces new limitations and penalties, with conditional exemptions in place for select industries until 30 June 2024.

Below are five key takeaways every employer must understand to avoid compliance risks and financial penalties.

The New Fixed-Term Limits Apply to Contracts from 6 December 2023

From 6 December 2023, employers can only engage employees on fixed-term contracts for a maximum of two contracts or up to two years (whichever is shorter) if the contracts relate to the same or similar role. These Fixed-Term Limits are aimed at preventing employers from rolling over fixed-term contracts indefinitely.

Employers must be aware that the changes do not apply retrospectively—only new contracts entered into after this date will be affected.

General Exemptions: Who’s Not Affected?

Certain roles and industries are exempt from these limitations. Fixed-term contract restrictions will not apply to:

- Apprentices and trainees

- Employees earning above the high-income threshold ($167,500)

- Specialist workers performing discrete tasks

- Employees covering temporary absences (e.g., maternity leave)

- Seasonal or peak-period workers

- Roles explicitly permitted under a Modern Award

Conditional Exemptions Until 30 June 2024

Recognizing industry concerns, the government has provided temporary exemptions for specific sectors. Employers in these industries have a reprieve until 1 July 2024:

- Organised Sport: Contracts involving athletes, coaches, performance staff, and match officials.

- Higher Education: Employees covered by the Higher Education Industry Awards.

- Live Performance: Roles covered under the Live Performance Award 2020.

- Funded Philanthropic Employment: Contracts funded by philanthropic entities or through testamentary contributions for charitable purposes.

Businesses in these industries should review their fixed-term contracts before the exemptions expire.

New Compliance Obligations: Mandatory Contract Statements

Employers must now provide two key documents when engaging a fixed-term employee:

- A Fixed Term Contract Information Statement (available from the Fair Work Ombudsman on 6 December 2023)

- A Fair Work Information Statement

Failure to provide these documents can lead to compliance breaches and penalties.

Breach Penalties: What Employers Risk

Employers found in breach of the new provisions face significant civil penalties:

- Up to $93,900 per contravention for businesses (or up to $939,000 for serious contraventions)

- Up to $18,780 per contravention for individuals (or up to $187,800 for serious contraventions)

- Individuals, including managers knowingly involved in breaches, can also be personally fined.

Next Steps for Employers

With these substantial changes, employers must take proactive measures to ensure compliance.

- Review all existing and upcoming fixed-term contracts for compliance with the new limitations.

- Train hiring managers and HR personnel on the updated laws to prevent inadvertent breaches.

- Ensure all employment contracts align with Fair Work Act amendments and meet the required documentation standards.

- Seek legal advice to clarify industry-specific implications and avoid costly compliance failures.

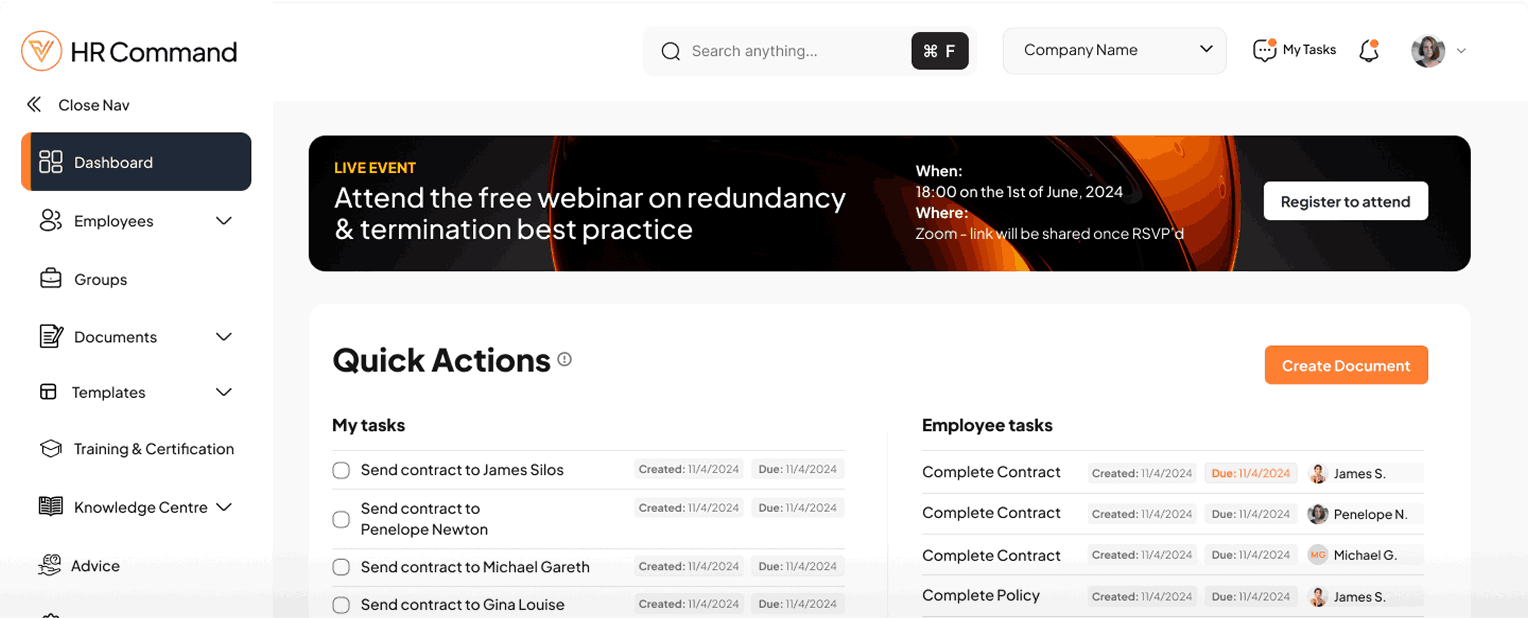

Need Expert Guidance?

Get in touch with our friendly HR Command specialist to get more information about our extensive offer.

For further details, refer to the full legislation here: Fair Work Amendment (Fixed Term Contracts) Regulations 2023.

Get in touch with your friendly HR Command specialist today to learn how HR Command products can support your HR needs.